BradenLive

Things I write live here

What I Learned As A VC Intern

For 10 weeks this fall, I worked part-time at Tensility Venture Partners in downtown Chicago. Here’s what I learned.

About Tensility

Tensility Venture Partners has two general partners, Armando Pauker and Wayne Boulais. Their experience spans over 20 years of venture investing, beginning at Apex Venture Partners and then two funds at Tensility. The firm has the following focus:

Tensility Venture Partners is a seed-stage venture capital firm that partners with mission-drive founders of early-stage enterprise AI startups, with a focus on software for cybersecurity and digital health, as well as novel, vertical-focused applications for artificial intelligence.

I found this focus to be especially valuable for me, since I had summer internship experience at a company called Narrative Science, which is a B2B company whose products depend on AI and Natural Language Generation (NLG). Several of Tensility’s portfolio companies also work in the NLG space, including Agolo and Stabilitas.

My role

Armando and Wayne were extremely accommodating to me coming in as an intern. They treated me as the third member of the team, and attempted to schedule any new company pitches on the two days a week that I was in the office with them. As a result of this, I was able to attend 40+ pitches from technology startups focused on a wide range of industries.

My second day in the office also happened to be the annual meeting for Tensility’s limited partners - so I was able to meet a number of LPs including those who acted as advisors to the GPs and with whom I would work closely on the upcoming due diligences.

Finally, I was able to attend several board meetings (remotely) that occurred during my time at Tensility. It was a great opportunity to better understand the complicated VC/founder relationship and the particular value-add that Armando and Wayne bring to the table.

Projects I worked on

My day-to-day responsibilities were to listen to pitch presentations, take notes, and then share my opinion afterwards. Beyond these basic tasks, I focused on three main projects (in chronological order):

- Conducting due diligence on Stabilitas

- Updating the Tensility website/creating content

- Conducting due diligence on another startup

Stabilitas due diligence

Stabilitas is the trusted platform for critical event intelligence, helping businesses manage enterprise risk to their assets across the globe. The start of my internship coincided with the beginning of the diligence process on Stabilitas, so Armando and Wayne asked me to lead the effort. This was especially lucky for me, as the two founders of Stabilitas are both military veterans like myself as well as recent MBA graduates. I immediately had a great connection with them.

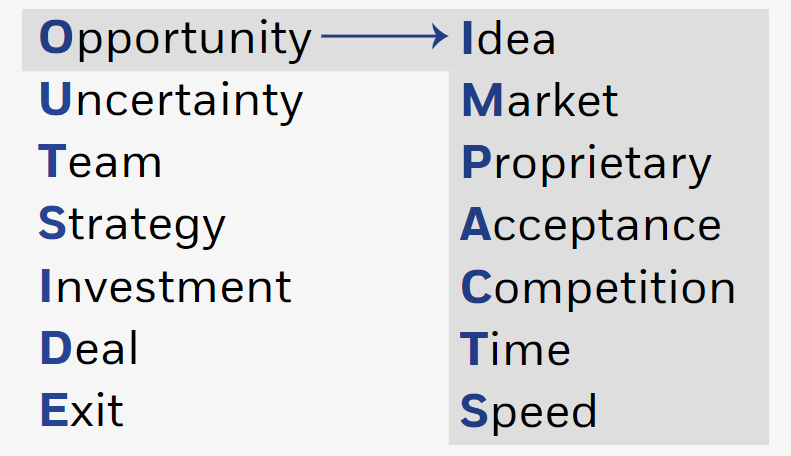

After securing access to a data vault set up by the CEO, I checked off a list of documents that we needed to complete the diligence. Tensility uses an approach similar to Steve Kaplan’s OUTSIDE IMPACTS framework in order to systematize the evaluation of sometimes-opaque venture investing decisions.

Since I learned this framework in previous Kellogg coursework, the diligence process at Tensility felt very familiar.

In the process of writing the investment memo, I conducted market research to understand the potential opportunity and risks, and I also created financial models to attempt to estimate the IRR and cash-on-cash returns various scenarios. Ultimately, the GPs and I consulted with Tensility’s advisors and decided to invest.

Website update/content creation

Coming into the internship, I had some strong opinions about the Tensility website as it stood. The site was not a good reflection on a firm that invested at the cutting edge of technology - AI. It was not ideally formatted and had some unflattering stock art:

Luckily, the GPs were on the same page as me on this, and were intending to make some changes themselves. Evaluating this from a user’s perspective (i.e. a potential inbound entrepreneur considering approaching Tensility for funding), I revamped the site to be cleaner and more up to date:

This coincided with a deliberate effort to create content for the firm’s new Twitter account and existing LinkedIn page, so I also ended up writing several blog posts.

Second due diligence

In the last few weeks of my internship, I began completing due diligence on another startup. The company uses AI voice recognition to aid in the phone and drive-thru ordering process, reducing costs and creating upsell opportunities for quick-service restaurant (QSR) owners and franchisees. Using the same framework as before, I was able to make significant progress in the diligence before my internship unfortunately came to an end.

Key new knowledge gained

- Talking to customer/personal references was the most revealing and valuable. For the diligence process on Stabilitas, I talked to 5-6 references on the two founders as well as two of their biggest customers. This yielded the most insight into the potential of the company. It really drove home the fact that so much of VC is qualitative rather than quantitative - VC is a business surprisingly focused on people, at least when operating in the early seed stage.

- Utter ambiguity of market sizing/financial scenarios. In line with the previous point, there were more question marks than known data points when attempting to game out market sizing (bottoms-up and top-down) and potential financial outcomes for the investment. Many companies operate in new spaces for which no comparables exist, or operate across several markets - making it difficult to estimate the total market. In the seed stage, these quantitative assessment methods are really more of a “check the box” binary assessment determining if the investment should be made or not, rather than a prediction of reality.

- Pattern recognition is of utmost importance. The two previous points ladder up to this: that good pattern recognition is what ultimately makes a good venture capitalist. The fact that there are so many variables, and that so many of them are unknowns, means that patterns can be very hard to discern. The long time horizon of seed investments also means a long gap between input and output, making it harder to attribute successful or unsuccessful exits to particular conditions at the time of investment. There are some heuristics that can make this process easier, but not many.

Any issues that arose

There were none - Armando and Wayne were incredibly supportive people to work for, and I would recommend Tensility to any future Kelloggite looking to improve their pattern recognition and better understand venture capital.

Suggestions for future TVP interns

Be prepared to spend your days in the Tensility office in back-to-back pitch meetings, mostly via teleconference. Invest in some decently-soled shoes as both GPs prefer standing desks for these meetings! In all seriousness, the majority of your time will be spent in pitch meetings, so be ready to work on your other assignments outside of the two days in the office.